What Is Wealthfront?

One of the best performing robo-advisors on the market today, Wealthfront offers a service that was previously only available through an expensive personal financial advisor. They put an emphasis on helping you develop and achieve goals while also taking your complete financial situation into account.

Since their release, they have managed close to $11.5 billion in assets and are fairly well-liked. The service is quite popular among Millennials. After all, when it comes to retirement savings, time is in their favor.

However, this information is plenty for anyone interested in increasing their money through automatic investment. To understand why let’s look at this platform in more detail below.

The fact that you’ve taken a moment to scrutinize this product before signing up should be applauded. You’ve done yourself a huge favor. Your due diligence will save you from potentially wasting your time and money.

A good bit of research always goes a long way in the fight against online scams. Creating a sustainable full-time online business is not difficult. You just need to know where to look.

Before we proceed I’d like to let you know that I’m not linked to Wealthfront in any sort of way and I’m not trying to sell you this product.

Instead, I’d like to show you why this program should be avoided…

Wealthfront Product Review

- Name of Product: Wealthfront

- Owner: Undisclosed

- Type of Product: Financial Investment and Wealth Management Platform

- Cost of Product: $500 to open an account, 0.25% management fee for accounts in excess of $5,000.

- Who Is This Product Best For? People looking for an accessible robo-advisor.

Wealthfront Product Summary

Wealthfront is regarded as one of the best and most easily accessible robo-advisors on the market right now. Wealthfront provides you with long-term financial freedom and security because of its minimal management fees, excellent referral program, and accessibility to emergency cash reserves.

This is why Wealthfront is a viable option if you’re serious about investing your money.

Product Rating: 80/100

Would I Recommend This Program: YES!

| Recommended: Discover how you can build a Full-Time 4-Figure Monthly Income with No Previous Experience. |

Wealthfront Background

Wealthfront is one of the many robo advisors available you’ll find in the market today. These automated investing platforms have made investing more accessible by offering services that formerly required hiring a pricey personal advisor.

And because all you have to do is put your money in a Wealthfront account, they have gained huge popularity. A tax-deferred Individual Retirement Account, or IRA, is another option.

Like the majority of robo-investing platforms, Wealthfront automates asset allocation using MPT, or Modern Portfolio Theory. Automatic rebalancing, continuously ensures that allocations are accurate while taking into consideration your risk tolerance and financial objectives.

Additionally, Wealthfront just stepped up its game by adding more than 200 new ETFs that users may use to add to current portfolios or use to start a brand-new ETF portfolio. No matter what investments you make, the organization will manage and rebalance them on your behalf.

Investors seeking exposure to cryptocurrencies now have the option to invest in the Ethereum or Bitcoin funds from Grayscale, which was included in Wealthfront’s 2021 additions.

Socially Responsible, Risk Parity, Smart Beta, and single stock indexing options are now available in addition to traditional Wealthfront portfolios. If you feel comfortable using an entirely online platform, Wealthfront has options for the majority of investors.

To assist you in determining whether Wealthfront is the best fit for your portfolio, we will go deeper into its platform and features.

Inside Wealthfront

Like other robo-advisor investment platforms, Wealthfront collaborates with real financial professionals under the direction of renowned economist Burton Malkiel.

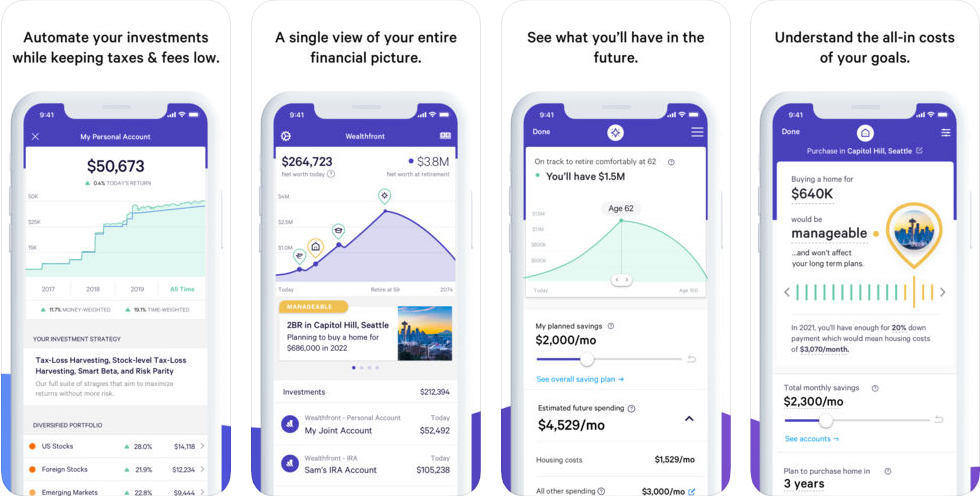

You are required to complete a questionnaire as part of the program to help calculate your asset allocations and gauge your risk tolerance. After that, Wealthfront will build you a portfolio of bonds, real estate ETFs, and stocks to provide you a wide financial exposure.

Simply put, Wealthfront makes sure that your funds are distributed in an optimal way to ensure your ongoing profitability.

Let’s now discuss the things that Wealthfront offers.

Automated Portfolio Rebalancing

By maintaining a balanced allocation between stocks, bonds, and other sectors, your portfolio is automatically rebalanced. This means that your portfolio is not designed to be invested exclusively in one area.

The Automated Portfolio Rebalancing will provide you with portfolio diversification. It continuously buys assets when they are low and sells them when they are high because this is done on a daily basis.

Automated Tax-Loss Harvesting

Each year, you are permitted to use a portion of your capital losses to lower your taxable income. Your income level will determine how much you may deduct, although you’re usually looking at $3,000 or less.

Financial advisors from Wealthfront (human ones, by the way) will assess your portfolio at the end of the year and will sell any losers (stocks that were formerly expensive when you bought them but are now priced cheap) to help you satisfy the deductible. Their Automated Tax Loss Harvesting function performs this automatically.

Stock-Level Tax-Loss Harvesting

Wealthfront concentrates on Stock-Level Tax Loss Harvesting as a strategy to enhance the outcomes of tax loss harvesting while keeping the fees as low as possible in order to maximize your revenues through taxable accounts.

As a result, Wealthfront will directly buy up to 1,001 individual equities on your behalf rather than using ETFs or index funds to invest in US stocks. This enables them to take advantage of the tax loss harvesting opportunities provided by the movement of these specific equities, which will ultimately result in higher returns.

Your annual earnings can grow by up to 2.03% when you use stock-level tax loss harvesting.

Dividend Reinvestment Aids Rebalancing

The only options available to you when receiving dividends from a typical human broker are to cash them out or reinvest them in the same mutual fund. In the long run, this enables you to receive greater dividends.

Wealthfront offers you this feature by investing your dividend from an ETF holding stocks in an undervalued bond ETF. This is a more effective use of the money that was taken out of your account.

| Recommended: Everything Needed To Create Your Full-Time Online Business From Scratch Can Be Found Right Here |

Wealthfront Invite Program

By requesting that friends sign up for the service and fund their accounts, you can participate in Wealthfront’s referral program. In accordance with the present model, referees are given free management of an additional $5,000 in assets for each person they invite to use the service and fill their account.

Getting Started With Wealthfront

A $500 minimum deposit is needed to join Wealthfront in order to use all of its features.

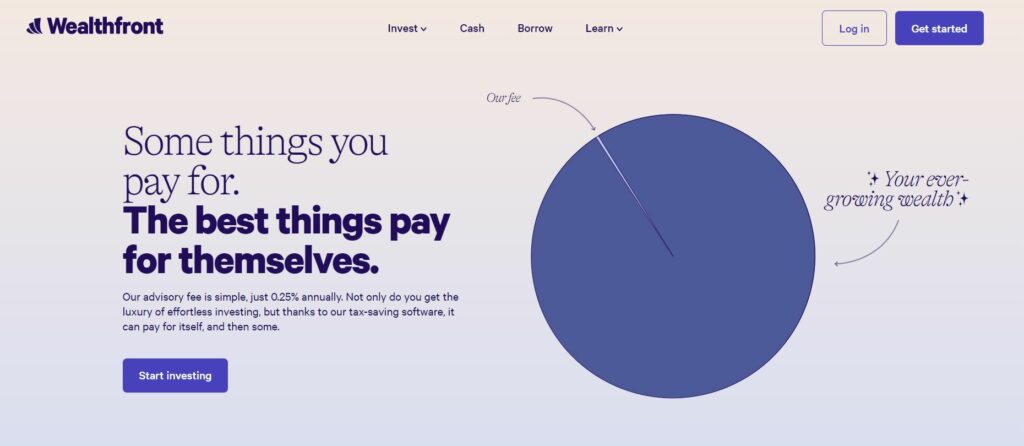

Then there are the costs that you must pay annually. The pricing structure is pretty simple. Your account’s first $5,000 are managed at no cost to you. Any surplus is subject to a 0.25% management fee. The ETFs themselves are a separate cost that you must pay. The typical ETF fee is 0.12%, which is less than the average for the sector.

Wealthfront Ugly Truths Exposed!

#1 $500 Minimum Deposit Is Required

Although it is a minor concern, I would bring up that Wealthfront’s rivals don’t have a minimum deposit requirement. Since there are alternative platforms that are quite similar to Wealthfront, this may discourage some from using it. You probably won’t want to use Wealthfront if your finances are quite tight.

Advantages of Wealthfront

#1 No Exorbitant Fees

Most robo-advisors charge more fees than Wealthfront does. You’ll only need to spend $12.5 a year to manage $10,000 worth of assets, but keep in mind that amount will increase if your overall balance increases as well.

#2 There Is A Referral Program

You can invest larger sums while only paying a little amount in fees thanks to their referral scheme. Once more, you receive an extra $5,000 managed for free each time someone signs up and funds their account using your referral URL. Your friends and anyone who sign up using your account will each receive an additional $5,000 managed for free.

Is Wealthfront a Scam or a Legit Program?

Wealthfront is a legit robo-advisor with eight years of experience who is in charge of managing billions of dollars’ worth of assets. Due to its low fees, Wealthfront makes it very affordable for others, and its credit line gives you financial flexibility.

How Do I Use The Internet to Make a Full-Time Salary?

I’m not a big fan of get-rich-quick schemes, let’s just say that I’ve been caught short a few times.

Instead, an Amazon FBA Business is my leading recommendation for people that want to build a thriving full-time online business working from home.

Here are my reasons why…

- There’s no pressure to recruit family and friends, or anyone else for that matter.

- Learn a unique method to source incredible, high-profit, low-competition products that are virtually hidden from your competitors.

- You don’t need to sell hundreds of different products to create lucrative profits with this fresh, exciting business model.

An Amazon FBA business can help you to…

Generate a 5-7 Figure Salary and become financially free from the limitations of a traditional day job. You can do this in less than 12 months!

If you want to find out how I did it, Click Here!

Similar Programs To Be Aware Of:

- What Is Stack That Money? The Best Forum For Affiliate Marketers?

- What Is Pennies 4 Profits? Not A Good Lead Generation Service!

- What Is Javita? Make Money By Selling Coffee Products?

- What Is Seller Pro Academy? Is Jonny Bradley’s Course For You?

- What Is Juice Plus? Find Out More About This Money-Making Opportunity Here!

- What Is Profit Squirrel? Is Matched Betting Safe For You?

- What Is LeapVista? Is This Dropshipping Course Worth Your Time?

- What Is Elite CEOs? Can Tanner Chidester’s Program Make You Money?

- What Is Rich Dad Summit? Is This Seminar Worth Attending?

- What Is 6 Figure Affiliate Bootcamp? Is This Course Any Good?

- What Is List Leverage? Can This Program Make You Rich?

- What Is Proofread Anywhere? Make Money As A Proofreader!

- What Is Passive Income Geek? Check Out Morten Storgaard’s Course!

- What Is Parallel Profits? Can This Program Make You Rich?

- What Is Personal Capital? The Best Robo-Advisor?

- What Is PrizeRebel? Learn More About This GPT Site Here!

- What Is OfferNation? Is This GPT Worth Your Time?

- What Is Nine University? Can FBA Make You Succeed?

- What Is FBS? Check Out This Online Trading Company!

- What Is eCom Success Academy? Learn About Dropshipping Here!

- What Is Netsphere? Is This Dropshipping Course Legit? Find Out Here!

- What Is My Business Venture? Check Out This DFY Product!

- What Is Explode My Payday? Another Day, Another Scam!

- What Is Discover The Plan? Read Our Review Here!

- What Is ProfitZBuddy? Legit Or A Get Rich Quick Scheme?

- What Is Market Hero? Find Out What This Is All About Here!

- What Is TrafficWave? Check Out This Affordable Autoresponder!

- What Is Sam Ovens Uplevel Consulting? Check Out Our Review!

- What Is Partner With Anthony? There Are Better Courses For You!

- What Is Click Clone Cash? Avoid This Get Rich Quick Scam!

- What Is Profit Fix Formula? Your Introduction To Sales Funnels!

- What Is 16K Swipes? Check Out Our Review!

- What Is Oxford Income Letter? It’s A NewsLetter For Trading!

- What Is Paribus? Check Out This Cash Back App!

- What Is AWOL Academy? It’s An Overly Expensive Course!

- What Is Making Sense of Affiliate Marketing? Let’s Find Out!

- What Is My Freelance Paycheck? Make $1000 Through Content Writing?

- What Is News Feed Authority? No More Paid Ads?

- What Is Ecom Beast 2.0? The Best Course On Entrepreneurship?

- What Is CEO Movement? Can You Be Successful With Mindset Training?

- What Is Freedom Formula? Make Thousands Of Dollars A Month?

- Is DMM System A Scam? Save Your Money From This Scheme!

- Easy Retired Millionaire Review: Stay Away From This Scam!

- What Is Local Marketing Vault? Check Out This $3,000 Course!

- What Is Funnel Hacking Secrets? Let Your Business Succeed With This Course!

- What Is eComm Clubhouse? Check Out This Dropshipping Course!

- What Is Just One Dime? The Best Amazon FBA Course?

- What Is Affiliate Bots? Check Out This Automated Affiliate Marketing!

- What Is GetUpside? The Best Cashback Platform?

- Is ClixSense A Scam? Learn How To Earn Money With This GPT Site!

- What Is K Money Mastery? Make Money Through eBooks!