What Is Personal Capital?

Robo-advisors are positioned at the low end of the market range for financial advice, while financial advisers are at the high end. Then there is Personal Capital, which combines human advisors and robo-advisor algorithms aiming to give you the best of both worlds.

The robo-advisor services offered by Personal Capital are not suitable for those who are just starting out in the world of investing due to their extremely high account minimums and above-average management fees.

Instead, it is intended for mass wealthy individuals who value greater levels of service, thanks to its powerful platform and simple access to competent financial advisors.

If you’d like to find out more about Personal Capital, just keep on reading.

The fact that you’ve taken a moment to scrutinize this product before signing up should be applauded. You’ve done yourself a huge favor. Your due diligence will save you from potentially wasting your time and money.

A good bit of research always goes a long way in the fight against online scams. Creating a sustainable full-time online business is not difficult. You just need to know where to look.

Before we proceed I’d like to let you know that I’m not linked to Personal Capital in any sort of way and I’m not trying to sell you this product.

Instead, I’d like to show you why this program should be avoided…

Personal Capital Product Review

- Name of Product: Personal Capital

- Owner: Bill Harris, Louie Gasparini, and Rob Foregger

- Type of Product: Financial Investment and Wealth Management Platform

- Cost of Product: Free to sign up (annual fees apply to investments only)

- Who Is This Product Best For? People interested in investing their finances

Personal Capital Product Summary

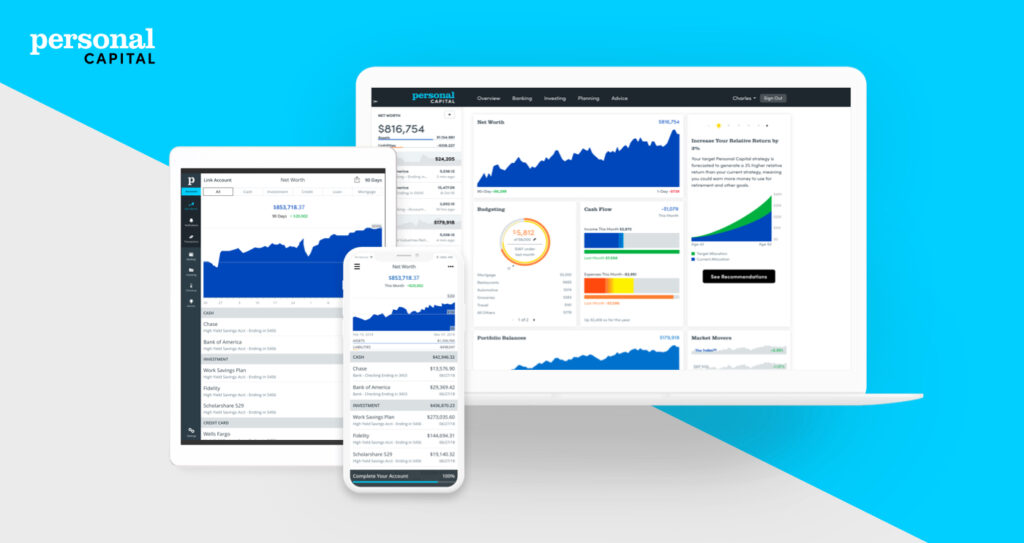

Investors can use Personal Capital, a platform for managing their finances and making investments, for both free and paid features. The Free features are sufficient in scope to rival the best financial management products currently available.

They have good Wealth Management tools that are managed by both human and robo-advisors and require a minimum deposit from you.

Additionally, Personal Capital creates a distinctive product in the robo-advisor market by fusing the traditional financial advisor experience with some automated capabilities.

You’ll have access to human advisors who can assist in building portfolios that are customized to your financial objectives and have access to the advantages of automatic tax-loss harvesting.

The annual management cost for this level of service is unfortunately one of the highest among robo-advisors, and it only modestly decreases when your portfolio worth increases.

Personal Capital will probably be less expensive than a traditional financial advisor, but there are other robo-advisors who can offer comparable levels of service for a lot less money.

Product Rating: 80/100

Would I Recommend This Program: YES!

| Recommended: Discover how you can build a Full-Time 4-Figure Monthly Income with No Previous Experience. |

Personal Capital Background

One of the earliest digital investment managers and top robo-advisor for portfolio management, Personal Capital was founded in 2009.

The company, which was acquired by Empower Retirement in 2020, stands out for offering a wide range of free money management tools for cash flow, retirement planning, and investment management. Any U.S. citizen can use Personal Capital Cash to get a range of free banking services along with a high-return savings account.

Full-service investment manager Personal Capital Advisors has a $100,000 minimum investment requirement and charges fees starting at 0.89 percent of AUM.

While anyone interested in keeping track of their finances can use the free tools, higher net worth individuals and families will value the individualized investment management services, holistic wealth management, and access to Certified Financial Planners that Personal Capital provides.

Inside Personal Capital

The free Financial Dashboard and Personal Capital Wealth Management are the two versions that Personal Capital offers.

Despite the fact that these services are similar, you receive significantly different benefits from each of them. Let’s examine each of them separately.

Free Financial Dashboard

The free version’s investment capabilities are extremely robust, but it’s most frequently used as a budgeting program. The free edition of Personal Capital will offer you helpful investment guidance even if you don’t intend to use it for budgeting.

The dashboard primarily serves as a financial aggregator, which means it can store all of your accounts, including those for credit cards, loans, savings, and investments.

It compiles all aspects of your present financial situation onto one platform. Even employer-sponsored retirement plans are allowed, which the free version excels at.

The following features are available with the free Financial Dashboard:

- Budgeting

- Cash Flow Analyzer

- 401(k) Analyzer

- Retirement Planner

- Investment Checkup

- Net Worth Calculator

- Personal Advisor

Wealth Management

The Wealth Management service, which is categorized as robo-advisers, is also available on Personal Capital.

However, it’s not totally true. Although the platform’s investment tools are automated, active human investors still perform the majority of the manual labor. As a result, the service occupies the same space as both human and robo-advisors.

Your risk tolerance, investment objectives, and time horizon are the first things Personal Capital establishes. When building your portfolio and managing it in accordance with Modern Portfolio Theory (MPT), they also take into account your personal preferences. They also rebalance your investment portfolio to keep it within goal ranges.

Six asset classes are included in the portfolio:

- U.S. stocks

- U.S. bonds

- International stocks

- International bonds

- Alternative investments, including real estate investment trusts, energy, and gold

- Cash

The drawback is that access to Wealth Management requires a minimum initial payment of $100,000 ($200,000 for ongoing access to financial advisors).

| Recommended: Everything Needed To Create Your Full-Time Online Business From Scratch Can Be Found Right Here |

Getting Started with Personal Capital

While it’s free to sign up for Personal Capital if you want to enjoy the full benefits of their services you will have to pay. Three service tiers with differing fees and minimum balances are available from Personal Capital:

- Investment Services – You pay a 0.89% fee for a portfolio of managed ETFs and assistance from one financial advisor for balances between $100,000 and $200,000.

- Wealth Management -You pay the same 0.89% charge for holdings between $200,000 and $1 million, but you also have access to two financial advisors and a portfolio that occasionally includes particular equities.

- Private Clients – Fees start to decline for balances beyond $1 million and eventually reach 0.49% if you reach $10 million. You gain access to the investment committee of Personal Capital, two financial advisors, additional support for your retirement planning, and even private equity investment alternatives by doing this.

The aforementioned tools for managing expenditures, budgets, and portfolios as well as Personal Capital Cash, the company’s checking account, do not have any requirements or fees.

However, whatever your opinion of Personal Capital’s products may be, these costs are high. Personal Capital’s fees would total nearly $70,000 if you started with $150,000 invested, added $10,000 annually, and received a meager return of 7% over a 15-year period.

Personal Capital Ugly Truths Exposed!

#1 Expensive!

Even if you can use the free services, if you want to use Wealth Management services, you still have to pay for them.

I would also contend that there are trading systems available that are less expensive and only need a slightly lower initial commitment. The hefty fees for the services are significantly greater than those charged by robo-advisors, which typically range from 0.25 percent to 0.40 percent.

However, I would draw attention to the fact that Personal Capital offers investment management services that are somewhat automated and more similar to traditional human investment managers.

Advantages of Personal Capital

#1 Wide Range Of Tools & Services

You may access a wealth of investment tools through their free Financial Dashboard, which can rival other financial investment platforms that you would often have to pay for. Despite the limitations of its budgeting functionality, Personal Capital offers enough to warrant your time.

Additionally, it’s crucial to keep track of your earnings and losses whether you’re making money offline or online. Because of this, their aggregation features provide you access to all of your finances in a single location and a service that is simple to use.

All of your costs are waived annually when you sign up for Wealth Management. There are no unstated costs.

Is Personal Capital a Scam or a Legit Program?

Even when you subscribe for free, Personal Capital is a very reliable wealth management and investment platform that offers you a wide range of options. Overall, the platform shows you how your finances stand and what you can do to make them better.

How Do I Use The Internet to Make a Full-Time Salary?

I’m not a big fan of get-rich-quick schemes, let’s just say that I’ve been caught short a few times.

Instead, an Amazon FBA Business is my leading recommendation for people that want to build a thriving full-time online business working from home.

Here are my reasons why…

- There’s no pressure to recruit family and friends, or anyone else for that matter.

- Learn a unique method to source incredible, high-profit, low-competition products that are virtually hidden from your competitors.

- You don’t need to sell hundreds of different products to create lucrative profits with this fresh, exciting business model.

An Amazon FBA business can help you to…

Generate a 5-7 Figure Salary and become financially free from the limitations of a traditional day job. You can do this in less than 12 months!

If you want to find out how I did it, Click Here!

Similar Programs To Be Aware Of:

- What Is PrizeRebel? Learn More About This GPT Site Here!

- What Is OfferNation? Is This GPT Worth Your Time?

- What Is Nine University? Can FBA Make You Succeed?

- What Is FBS? Check Out This Online Trading Company!

- What Is eCom Success Academy? Learn About Dropshipping Here!

- What Is Netsphere? Is This Dropshipping Course Legit? Find Out Here!

- What Is My Business Venture? Check Out This DFY Product!

- What Is Explode My Payday? Another Day, Another Scam!

- What Is Discover The Plan? Read Our Review Here!

- What Is ProfitZBuddy? Legit Or A Get Rich Quick Scheme?

- What Is Market Hero? Find Out What This Is All About Here!

- What Is K Money Mastery? Make Money Through eBooks!

- What Is Moneybuildrr? Don’t Waste Your Time On This Product!

- What Is Ecommerce Millionaire Mastery? What You Need To Know About Kevin Zhang’s Course!

- What Is Last Amazon Course? Check Out This Affordable Amazon FBA Program!

- What Is Data Science Dream Job? Find Out About This Course Here!

- What Is Chris Farrell Membership? How To Make Money With This?

- What Is Amazon FBA Ninja? Can You Be Successful With This Course?

- What Is Jumpcut Academy? Check Out This Youtube Training Program!

- What Is Attraction Marketing Formula? Check Out This Review!

- What Is FB Academy? How To Succeed With Facebook Ads?

- What Is High Ticket Closer? Can Dan Lok Teach You To Get High Ticket Sales?

- What Is The Invincible Marketer? Does Aaron Chen Live Up To The Hype?

- What Is Wealthy Leads? Is This Course Worth Your Money?

- What Is Paribus? Check Out This Cash Back App!

- What Is AWOL Academy? It’s An Overly Expensive Course!

- What Is Making Sense of Affiliate Marketing? Let’s Find Out!

- What Is My Freelance Paycheck? Make $1000 Through Content Writing?

- What Is News Feed Authority? No More Paid Ads?

- What Is Ecom Beast 2.0? The Best Course On Entrepreneurship?

- What Is CEO Movement? Can You Be Successful With Mindset Training?

- What Is Freedom Formula? Make Thousands Of Dollars A Month?

- Is DMM System A Scam? Save Your Money From This Scheme!

- Easy Retired Millionaire Review: Stay Away From This Scam!

- What Is Local Marketing Vault? Check Out This $3,000 Course!

- What Is Funnel Hacking Secrets? Let Your Business Succeed With This Course!

- What Is eComm Clubhouse? Check Out This Dropshipping Course!

- What Is Just One Dime? The Best Amazon FBA Course?

- What Is Affiliate Bots? Check Out This Automated Affiliate Marketing!

- What Is GetUpside? The Best Cashback Platform?

- Is ClixSense A Scam? Learn How To Earn Money With This GPT Site!

- What Is Dreamstime? Make Money By Taking Photos?

- What Is Bye 9 To 5? Check Out Jordan Mackey’s Course Here!

- What Is Affiliate Beast? Check Out Deshayla Flowers’ Course Here!

- What Is BJK University? Worth The Money Or Overpriced?

- What Is Store Formula? Is This eCommerce Course Anything Special?

- What Is Money Press Method? Find Out In This Review!

- What Is Passion Product Formula? Check Out This Review!

- What Is Ecom Babes? Is Cortney Fletcher’s E-commerce Course Good?

- What Is Jeff Walker’s Product Launch Formula? Find Out Here!